Navigating the rental market requires a solid understanding of various aspects, one of the most crucial being security deposits. This comprehensive guide delves into the intricacies of security deposits, providing prospective and current tenants with the essential knowledge they need. Understanding your rights and responsibilities regarding security deposits can empower you to protect your finances and ensure a smooth rental experience. We’ll cover topics such as the purpose of security deposits, limits on security deposits, permissible deductions from security deposits, and the process for returning security deposits. By grasping these key concepts, tenants can confidently enter into and maintain successful tenancies.

Are you prepared to understand the ins and outs of security deposits? This article will equip you with the knowledge necessary to confidently manage your security deposit. We will explore the legal framework surrounding security deposits, including state laws governing security deposits, tenant rights related to security deposits, and the proper procedures for handling security deposits. We’ll address common questions, such as “What can a landlord use a security deposit for?”, “How do I get my security deposit back?”, and “What are my options if my landlord wrongfully withholds my security deposit?”. Learn how to safeguard your interests and navigate the complexities of rental agreements with confidence.

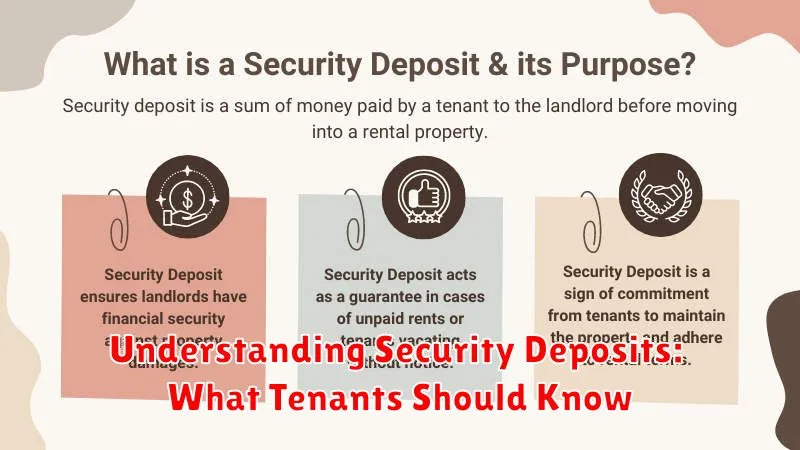

What Is a Security Deposit?

A security deposit is a sum of money paid by a tenant to a landlord at the beginning of a lease. It acts as financial protection for the landlord against potential damages to the property, unpaid rent, or other breaches of the lease agreement.

This deposit is held in trust by the landlord and is typically returned to the tenant at the end of the lease term, provided the tenant has fulfilled all obligations outlined in the lease. Any deductions from the security deposit must be justified by the landlord with proper documentation, such as receipts for repairs.

The amount of the security deposit is generally limited by state or local laws, and these laws also often dictate how the deposit must be held and returned. It’s crucial for tenants to understand these laws and their rights regarding security deposits.

Typical Deposit Amounts

Security deposit amounts can vary, influenced by factors like location, property type, and market conditions. Landlords often set deposits equivalent to one or two months’ rent. However, some states or localities impose limits on the maximum amount a landlord can request.

For example, a property with a monthly rent of $1,500 might require a security deposit between $1,500 and $3,000. Tenants with pets or a history of credit issues might encounter higher deposit requirements. It’s crucial for prospective tenants to inquire about the specific deposit amount during the application process.

When Is It Collected?

A security deposit is typically collected before a tenant moves into a rental unit. This occurs during the lease signing process, after the lease agreement has been reviewed and agreed upon by both the landlord and tenant.

Landlords may require payment of the security deposit simultaneously with the first month’s rent or shortly before the tenant takes possession of the property.

How Deposits Are Held

Security deposits are typically held in escrow accounts. This means the funds are held by a neutral third party—separate from both the landlord and the tenant—until the lease ends.

Landlords are legally required to adhere to specific regulations regarding security deposit handling. These regulations often dictate where the deposit can be held, how it must be documented, and under what circumstances it can be accessed.

Some states require landlords to provide tenants with information about the escrow account, including the name and location of the financial institution. Be sure to understand your state’s specific laws regarding security deposit handling.

Conditions for Withholding Deposits

Landlords can typically withhold portions or all of a security deposit to cover unpaid rent, property damage exceeding normal wear and tear, and other breaches of the lease agreement.

Unpaid rent is a common reason for withholding. The outstanding balance is usually deducted directly from the deposit. Property damage often requires documentation, such as photographs and repair invoices. Examples include broken windows, damaged appliances, or holes in the walls. Breach of lease can involve unauthorized pets, early termination of the lease, or unauthorized occupants.

It is crucial to understand your lease agreement and local laws regarding security deposits to avoid disputes and ensure a smooth return of your deposit.

Getting Your Deposit Back

Retrieving your security deposit is a key concern for tenants. Thorough documentation is crucial throughout your tenancy. Take photos and videos of the property’s condition at move-in and move-out. This serves as evidence of the unit’s state and can protect you from unwarranted deductions.

Understand your lease agreement and the specific terms regarding deposit deductions. Normal wear and tear is acceptable, but excessive damage is not. Keep the property clean and address any maintenance issues promptly to minimize potential deductions.

Upon vacating the property, ensure it is thoroughly cleaned and returned to its original state (minus reasonable wear and tear). Communicate with your landlord regarding the move-out process and expected timeline for deposit return.

State Laws on Security Deposits

State laws govern many aspects of security deposits, creating a framework to protect both landlords and tenants. These laws vary significantly, impacting allowable deposit amounts, permissible deductions, and required return timelines.

For example, some states limit the maximum deposit amount to one or two months’ rent, while others have no such cap. Permissible deductions also differ, with some states explicitly outlining acceptable reasons for withholding portions of the deposit, such as unpaid rent or property damage.

Return timelines are another crucial aspect regulated by state law. Landlords are typically required to return the deposit within a specified timeframe after the tenant vacates, often ranging from two weeks to several months. Failure to comply with these regulations can result in penalties for the landlord.

Inspection Before Move-Out

A pre-move-out inspection is often a crucial step in the security deposit process. This inspection, typically conducted with the landlord or property manager, allows both parties to document the condition of the property before you leave.

During the inspection, take note of any existing damage and compare it to the initial move-in inspection report. This is your opportunity to address any discrepancies and potentially avoid deductions from your security deposit. The inspection also provides a chance to discuss any necessary repairs or cleaning that you are responsible for completing before your departure.

By participating in a pre-move-out inspection, you can proactively protect your security deposit and ensure a smooth transition out of the property.

Tips to Protect Your Deposit

Protecting your security deposit requires proactive steps and clear communication with your landlord. Here are some key tips:

Document the Condition

Thoroughly document the condition of the property before moving in. Take photos and videos of any existing damage, including scratches, stains, or broken fixtures. Ideally, complete a move-in inspection with your landlord and have both parties sign it.

Keep Records

Maintain records of all communication with your landlord, especially regarding repairs and maintenance requests. Keep copies of rent receipts and any repair bills.

Maintain the Property

Treat the property with care and address minor maintenance issues promptly. Follow the terms of your lease regarding cleanliness and upkeep.

Communicate with Your Landlord

Open communication is crucial. Inform your landlord immediately of any significant damage and coordinate repairs. Before moving out, discuss cleaning expectations and the move-out inspection process.

What to Do If It’s Not Returned

If your landlord fails to return your security deposit within the legally mandated timeframe, or returns less than you believe is owed, you should first attempt to communicate with them directly. Clearly outline your understanding of the deposit agreement and any discrepancies. Providing documentation, such as photos or videos taken at move-in and move-out, can significantly strengthen your case.

If communication doesn’t resolve the issue, your next step is typically to send a formal demand letter. This letter should reiterate your request for the return of the deposit and outline the legal basis for your claim. If this still doesn’t prompt action, you may need to consider pursuing legal remedies, such as small claims court.