Renter’s insurance. Do you need it? Many renters debate this question, weighing the cost against the potential benefits. Understanding what renter’s insurance covers is crucial to making an informed decision. This article will explore the key aspects of renter’s insurance, helping you determine if this valuable protection is right for you. We’ll delve into the specifics of common coverages, examine potential risks, and provide clear guidance on whether securing a renter’s insurance policy aligns with your individual needs.

From personal property protection to liability coverage and even additional living expenses, we’ll break down the core components of a typical renter’s insurance policy. Discover how renter’s insurance can safeguard your belongings against unforeseen events such as fire, theft, and vandalism. Learn about the importance of liability protection in case someone is injured in your rented space. By understanding the comprehensive protection afforded by renter’s insurance, you can confidently assess whether the cost of a policy outweighs the potential financial risks of being uninsured.

What Is Renter’s Insurance?

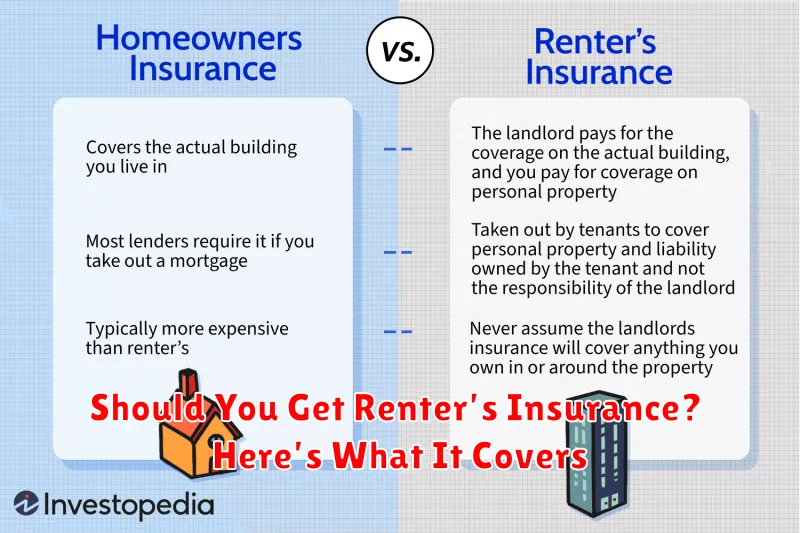

Renter’s insurance is a type of property insurance that provides coverage for a policyholder’s belongings within a rented property. It protects against losses from events like fire, theft, vandalism, and certain types of water damage. Unlike homeowner’s insurance, it doesn’t cover the actual structure of the building – that’s the landlord’s responsibility.

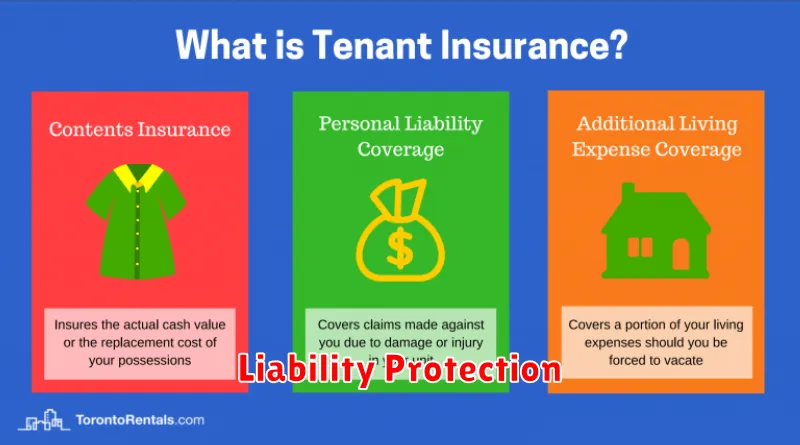

Renter’s insurance policies typically offer several key types of coverage:

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, clothing, and jewelry.

- Liability Coverage: Protects you if someone is injured in your rented space and you are found legally responsible.

- Additional Living Expenses (ALE): Covers the cost of temporary housing if your rental becomes uninhabitable due to a covered event.

Why It’s Important for Tenants

Renter’s insurance offers crucial protection for tenants against unforeseen events. While your landlord’s insurance covers the building structure, it typically doesn’t extend to your personal belongings. Renter’s insurance safeguards your possessions from damage or loss due to fire, theft, vandalism, and certain natural disasters.

Beyond personal property protection, this insurance provides liability coverage. If a guest is injured in your rented unit, you could be held responsible. Renter’s insurance helps cover legal fees and medical expenses, protecting you from significant financial strain. Additionally, it can provide loss of use coverage, which helps with temporary living expenses if your rental becomes uninhabitable due to a covered peril.

Coverage for Personal Property

Renter’s insurance provides crucial financial protection for your belongings. This coverage helps replace or repair your personal property if it’s damaged, destroyed, or stolen due to covered events. These events typically include fire, smoke, vandalism, theft, and certain types of water damage.

Covered items generally encompass furniture, electronics, clothing, jewelry, and other personal possessions. It’s important to document your valuables with photos or videos and keep an inventory list for a smoother claims process. Policies often have coverage limits, so consider higher limits or supplemental coverage for high-value items like jewelry or art.

Liability Protection

Liability protection is a crucial component of renter’s insurance. It safeguards you financially if you’re held responsible for accidental damage or injuries to others within your rented property or elsewhere. For instance, if a guest trips and falls in your apartment, resulting in medical expenses, your liability coverage can help cover those costs.

This protection extends to property damage as well. If you accidentally start a fire that damages your building or a neighbor’s belongings, your liability coverage can assist with the expenses. It provides a financial safety net, protecting your assets from potentially significant legal and medical costs.

Temporary Housing in Emergencies

Renter’s insurance often covers additional living expenses (ALE) if your home becomes uninhabitable due to a covered peril. This means your policy could pay for temporary housing, such as a hotel room or rental apartment, while repairs are made.

ALE coverage typically has limits, often expressed as a percentage of your overall policy coverage. It’s important to understand these limits to ensure you have sufficient protection. ALE may also cover increased costs associated with daily living, such as restaurant meals and transportation, if your temporary accommodations lack kitchen facilities or are located farther from your work or school.

What’s Not Covered

While renter’s insurance offers valuable protection, it’s crucial to understand its limitations. Certain events and possessions are typically excluded from standard policies. Flood damage, for instance, requires a separate flood insurance policy. Similarly, earthquakes and other “acts of God” may necessitate specialized coverage.

High-value items like jewelry, fine art, or collectibles often have coverage limits under standard policies. You might need additional “riders” or separate insurance for these valuables to ensure adequate protection. Damage caused by intentional acts by the renter is also typically excluded. Be sure to review your policy carefully to understand all exclusions and limitations.

How Much Does It Cost?

Renter’s insurance is surprisingly affordable. The average cost is between $15 and $30 per month. This small monthly payment can provide significant financial protection.

Several factors influence the premium you’ll pay. These include:

- Location: Areas with higher crime rates or greater risk of natural disasters typically have higher premiums.

- Coverage Amount: The more coverage you need for your personal belongings, the higher the cost.

- Deductible: Choosing a higher deductible lowers your monthly premium, but you’ll pay more out-of-pocket if you file a claim.

It’s wise to get quotes from multiple insurers to compare prices and coverage options.

Choosing the Right Policy

Once you’ve decided renter’s insurance is right for you, the next step is selecting the appropriate policy. Coverage amounts are a crucial consideration. Evaluate your belongings and choose coverage that adequately reflects their replacement value, not just their current market value.

Consider different deductible options. A higher deductible means lower premiums but greater out-of-pocket expense in the event of a claim. Conversely, a lower deductible translates to higher premiums but reduced immediate costs if you need to file a claim. Carefully weigh these factors based on your financial situation.

Finally, inquire about additional coverage options such as identity theft protection or flood insurance, which are often not included in standard policies but can offer valuable protection.

How to File a Claim

Filing a renter’s insurance claim is generally a straightforward process. First, contact your insurance company as soon as possible after the incident. Provide them with the details of the event, including the date, time, and a description of the damage or loss.

Next, you’ll likely need to document the damage. This could involve taking photographs or videos of damaged or stolen items. You may also need to provide proof of ownership for these items, such as receipts or photos showing them in your possession. Your insurance company will then guide you through the rest of the process, which may involve an inspection of your property and completion of necessary paperwork.

Landlord Requirements for Insurance

While renter’s insurance is generally not legally required, many landlords now mandate it as part of the lease agreement. This protects their property from potential damages caused by tenants.

Landlords often stipulate specific coverage amounts for liability and personal property. They might require proof of insurance before you move in or renew your lease. Failing to comply with these requirements can result in repercussions, including lease termination.

Review your lease carefully for any insurance clauses. It’s crucial to understand your landlord’s specific requirements and ensure your policy meets or exceeds those stipulations.