Considering a rent-to-own agreement? This comprehensive guide will unravel the complexities of rent-to-own agreements, often referred to as lease-purchase agreements or lease-options. We’ll explore the benefits and drawbacks of rent-to-own homes, helping you determine if this pathway to homeownership is right for you. Understanding the intricacies of option fees, purchase prices, and rent credits is crucial before entering into a rent-to-own contract. We’ll clarify these key components and provide essential insights into navigating the rent-to-own process.

Rent-to-own agreements can provide a unique opportunity for aspiring homeowners, particularly those facing challenges securing traditional financing. Learn how these agreements differ from traditional mortgages and rentals, and discover the potential advantages and pitfalls. This article will equip you with the knowledge necessary to make informed decisions about rent-to-own properties, covering everything from negotiating favorable terms to understanding your rights and responsibilities as a rent-to-own tenant. Whether you’re considering a rent-to-own house, condo, or other property type, this guide is your essential resource.

What Is Rent-to-Own?

Rent-to-own, also known as lease-to-own or lease purchase, is a hybrid agreement combining aspects of both renting and buying. It provides a pathway to homeownership for individuals who may not qualify for a traditional mortgage immediately.

The agreement typically involves two key components: a rental agreement and a purchase option. The renter makes regular monthly payments, a portion of which may go towards an eventual down payment. At the end of a predetermined lease period, the renter has the option, but not the obligation, to purchase the property at a pre-agreed price.

How Does It Work?

Rent-to-own agreements offer a pathway to homeownership for those not immediately ready for a traditional mortgage. A rental agreement is combined with an option to purchase the property at a later date.

An initial option fee is typically paid upfront, which secures the purchase price. A portion of your monthly rent payments may also contribute towards the future down payment. At the end of the agreed rental period, you exercise your option to buy the property at the predetermined price.

Benefits for Renters

Rent-to-own agreements offer several potential advantages for prospective homeowners. A primary benefit is the opportunity to lock in a purchase price at the start of the agreement. This protects against rising home values in the market.

Another advantage is the ability to build equity over time. A portion of each rent payment may be credited towards the eventual down payment, helping renters accumulate funds. This can be especially beneficial for those who struggle to save a large down payment quickly.

Furthermore, rent-to-own provides a trial period to experience living in the home and neighborhood before committing to a full purchase. This allows renters to assess the property’s suitability for their needs and lifestyle.

Risks and Drawbacks

Rent-to-own agreements can be beneficial in certain situations, but they also come with potential risks and drawbacks for prospective buyers. It is crucial to carefully consider these downsides before entering into such an agreement.

One significant risk is the potential loss of money invested if the buyer cannot complete the purchase. Missed payments can lead to eviction and forfeiture of any option payments made. Furthermore, rent-to-own properties may come with higher-than-market rent and inflated purchase prices, increasing the overall cost compared to a traditional mortgage.

Maintenance responsibilities often fall on the renter during the option period, potentially creating unexpected expenses. It is essential to thoroughly understand the terms of the agreement regarding repairs and upkeep. Finally, the lack of ownership until the final purchase means the buyer has limited control over the property and cannot build equity during the rental period.

Lease-Option vs Lease-Purchase

While both lease-option and lease-purchase agreements fall under the rent-to-own umbrella, they have key differences.

A lease-option gives the renter the option to buy the property at the end of the lease term. This option isn’t an obligation. The renter can choose to walk away at the end of the lease if they decide not to purchase.

In contrast, a lease-purchase agreement requires the renter to buy the property at the end of the lease. This is a legally binding commitment. The purchase price is often agreed upon upfront.

Who Maintains the Property?

Responsibility for property maintenance during a rent-to-own agreement is a critical aspect that requires clear definition. Typically, the responsibilities are similar to a standard lease agreement, with the potential buyer (renter) handling minor repairs and upkeep, while the owner remains responsible for major structural repairs and system maintenance.

However, since the renter is working towards ownership, the specific terms can vary. Some agreements may shift more maintenance responsibilities to the renter, preparing them for the full ownership experience. It is essential that both parties agree upon and clearly document these responsibilities within the rent-to-own contract to avoid disputes later.

Down Payments and Rent Credits

In a rent-to-own agreement, a down payment, also known as an option fee, is typically required. This upfront payment grants you the option to purchase the property at the end of the lease term. The amount can vary significantly, often ranging from 1% to 5% of the purchase price.

A portion of your monthly rent payments may be credited towards the final purchase price. This is called a rent credit. The percentage of rent allocated as a credit is predetermined within the agreement and contributes towards reducing your eventual purchase cost.

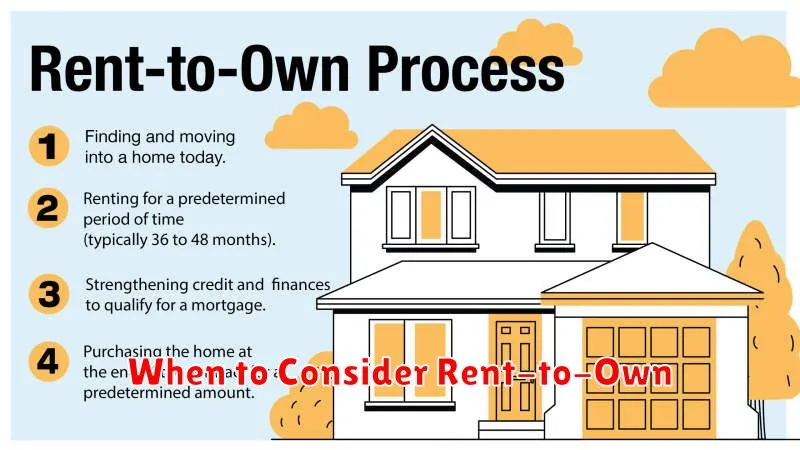

When to Consider Rent-to-Own

Rent-to-own agreements can be a viable path to homeownership under specific circumstances. Consider this option if you’re struggling to save a traditional down payment, but have stable income. A rent-to-own arrangement allows you to lock in a purchase price today, protecting you from potential future price increases.

Additionally, a rent-to-own setup can benefit those who need time to improve their credit score before qualifying for a conventional mortgage. The timeframe provided by the agreement allows potential buyers to build their creditworthiness while simultaneously building equity in the property.

If you’re unsure about a particular neighborhood or the responsibilities of homeownership, a rent-to-own agreement provides a “trial run” before committing to a full purchase. This can be particularly helpful for first-time homebuyers.

Legal Considerations

Rent-to-own agreements involve specific legal considerations that both tenants and landlords must understand. State laws vary significantly regarding rent-to-own contracts. Consulting with an attorney before signing is crucial to protect your rights.

Key legal aspects include the option fee, the purchase price, and the allocation of maintenance responsibilities during the rental period. Clear contract language outlining these aspects is essential to avoid disputes later on.

Also, understanding the implications of default by either party is critical. The contract should specify the consequences of missed rental payments or failure to exercise the option to buy.

Talk to a Real Estate Professional

Navigating a rent-to-own agreement can be complex. It’s highly recommended to seek guidance from experienced professionals.

A real estate agent can provide valuable insights into market conditions, property values, and the legalities of rent-to-own contracts. They can help you negotiate favorable terms and ensure the agreement protects your interests.

Consulting with a real estate attorney is also crucial. They can review the contract thoroughly, explain any complex clauses, and advise you on potential risks and legal implications. This professional advice can save you from costly mistakes and legal disputes down the road.