Entering a rental agreement as a co-signer carries significant responsibility. This comprehensive guide explores the crucial aspects of co-signing a lease, outlining the potential benefits and risks involved for both the tenant and the co-signer. Understanding the legal obligations of a co-signer is paramount before entering into such an agreement. This guide will equip you with the knowledge necessary to make an informed decision, covering topics like credit checks, lease terms, and the co-signer’s liability for rent payments and property damage. Whether you are considering co-signing for a friend, family member, or someone else, this guide will provide you with the essential information you need.

Co-signing a rental lease can be a valuable tool in helping someone secure a rental property, especially if they have limited credit history or a challenging financial situation. However, it’s critical to recognize the legal and financial ramifications that accompany this decision. This guide delves into the co-signer’s rights and responsibilities, including the potential impact on your own credit score. Learn what questions to ask before co-signing, how to protect yourself throughout the lease term, and what options are available if the tenant defaults on their rent payments. By understanding the intricacies of co-signing a lease, you can approach this situation with confidence and protect your financial well-being.

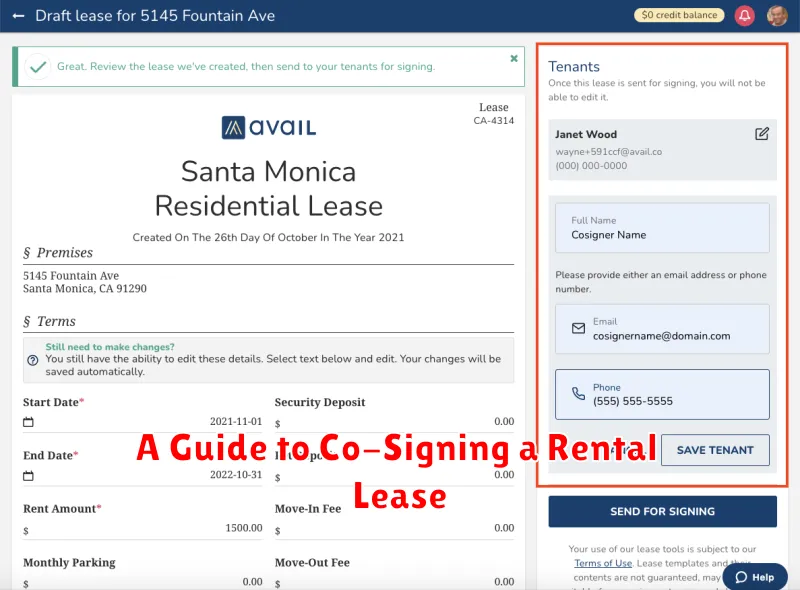

What Is a Lease Co-Signer?

A lease co-signer is an individual who legally agrees to take on the financial responsibilities of a rental lease if the primary tenant defaults. They essentially act as a guarantor for the lease agreement.

This means the co-signer is equally responsible for upholding all terms of the lease, including paying rent on time and covering any damages. Landlords often require a co-signer when a prospective tenant has a limited credit history, insufficient income, or other factors that indicate a higher risk of default.

By co-signing, the co-signer is putting their own credit on the line. Therefore, it’s a significant financial commitment that should be considered carefully.

When Is a Co-Signer Required?

A landlord may require a co-signer when a prospective tenant doesn’t meet their qualification criteria. This often happens when an applicant has a limited credit history, insufficient income, or a history of missed payments.

Landlords want to minimize financial risk. A co-signer provides an additional layer of security, guaranteeing rent payment if the primary tenant defaults. Students, recent graduates, and individuals relocating to a new city are common examples of renters who might need a co-signer.

Co-Signer Responsibilities

Co-signing a lease entails significant responsibilities. As a co-signer, you are equally responsible for upholding all terms of the lease agreement. This includes ensuring timely rent payments.

Should the primary tenant fail to meet their obligations, you are legally obligated to fulfill them. This means you could be held responsible for unpaid rent, late fees, and even property damage costs.

Your credit score can be negatively impacted if the tenant defaults on the lease. Co-signing should not be taken lightly; carefully consider the potential financial risks before agreeing to this responsibility.

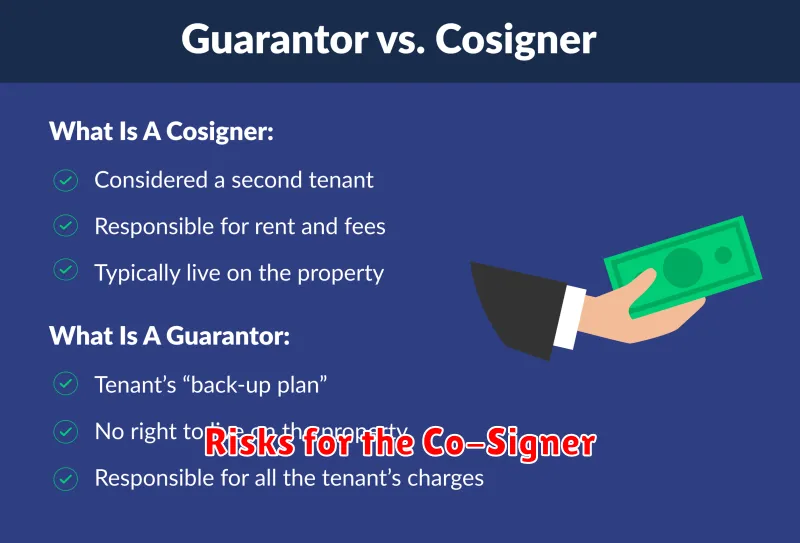

Risks for the Co-Signer

Co-signing a lease carries significant financial responsibility. As a co-signer, you are equally obligated to ensure rent payments and property upkeep. Should the primary tenant default, you are legally responsible for covering the remaining rent, any late fees, and potential damages.

This financial burden can negatively impact your credit score if the tenant fails to meet their obligations. Missed or late payments reported under the lease agreement will appear on your credit report, potentially hindering your ability to secure future loans or lines of credit.

Furthermore, co-signing might limit your own rental prospects. Your debt-to-income ratio might be affected, making it appear as though you have higher financial obligations than you actually do. Landlords may be hesitant to rent to you if they perceive you as overextended financially.

It is crucial to have a serious conversation with the prospective tenant and carefully consider the risks involved before agreeing to co-sign.

Protecting the Co-Signer’s Credit

Co-signing a lease carries significant responsibility. The co-signer is equally obligated to ensure timely rent payments and adherence to all lease terms. Failure by the primary tenant to meet these obligations directly impacts the co-signer’s credit score.

Open communication between the tenant and co-signer is crucial. Regularly discussing the tenant’s financial situation and confirming rent payments can help prevent potential credit damage. Establishing a system for payment reminders and confirmations can provide added security.

Co-signers should also monitor their credit reports. Regular checks allow for early detection of missed payments or other negative entries related to the co-signed lease. Prompt action can mitigate the damage and preserve creditworthiness.

Legal Rights of a Co-Signer

As a co-signer, you hold significant legal responsibilities and also possess certain rights. Understanding these rights is crucial for protecting yourself throughout the lease term.

Right to Information: You have the right to be informed about all aspects of the lease agreement, including any modifications or late rent notices. This ensures transparency and allows you to monitor the primary tenant’s adherence to the terms.

Right to Notice of Default: You are entitled to receive notification if the primary tenant defaults on the lease, such as failing to pay rent or violating lease terms. This early notification allows you to take action to mitigate potential financial losses.

How to Ask Someone to Co-Sign

Asking someone to co-sign is a significant request. Approach the conversation with preparation and respect. Clearly explain why you need a co-signer and what it entails. Be upfront about the financial implications for them, emphasizing their responsibility if you fail to meet the lease terms.

Present your rental application, budget, and credit report to demonstrate your financial situation and commitment to meeting your obligations. Answer their questions honestly and openly. Emphasize your gratitude for their consideration and be prepared to discuss alternative arrangements if they decline.

Alternatives to Using a Co-Signer

If securing a co-signer proves difficult, several alternatives exist. Increased Security Deposit: Offering to pay a larger security deposit can demonstrate financial responsibility to a landlord. Pre-Paid Rent: Paying several months’ rent in advance can also reassure landlords of your ability to meet your obligations. Strong Rental History: Providing positive references from previous landlords can offset concerns about a lack of credit history or income.

Another option is a guarantor, similar to a co-signer, but they guarantee payment if you default, rather than being equally responsible for the lease. Lastly, exploring renter’s insurance can provide added security for both you and the landlord.

How to Remove a Co-Signer from Lease

Removing a co-signer from a lease can be complex and depends heavily on the lease agreement itself and state laws. It’s not always a guaranteed option.

Often, the lease needs to be modified or a new lease drafted altogether. This requires the consent of both the tenant, co-signer, and landlord.

The co-signer may be released if the tenant can demonstrate they can independently meet the landlord’s financial requirements. A strong rental history and proof of sufficient income can be helpful in these situations.

If the lease doesn’t address co-signer removal, consult with a legal professional to understand your options.

Final Thoughts Before Signing

Co-signing a lease is a significant financial commitment. Before you sign, carefully review the entire lease agreement. Ensure you understand all the terms and conditions, including the length of the lease, the monthly rent, and any associated fees.

Open communication with the primary tenant is crucial. Discuss their financial stability and ability to make timely rent payments. Consider the potential impact on your credit score if the primary tenant defaults on the lease.

Finally, seek legal advice if you have any doubts or concerns. A legal professional can explain the implications of co-signing and help you make an informed decision.