Renting a home can be a significant financial commitment. Creating a comprehensive budget is essential for navigating the rental market successfully and ensuring you can comfortably afford your new home. This guide will walk you through the crucial steps of developing a rental budget, covering everything from calculating your affordable rent to anticipating additional rental expenses like utilities and moving costs. Learn how to assess your current financial situation, factor in potential rent increases, and establish a realistic budget that sets you up for a stress-free renting experience.

Developing a rental budget requires careful consideration of various factors, impacting your affordability. We will explore how to determine your maximum rent based on your income and expenses, emphasizing the importance of incorporating hidden costs often overlooked by first-time renters. This guide will equip you with the knowledge and tools to make informed decisions, ensuring you find a rental property that aligns with your financial capabilities and avoids potential financial strain. By following these steps, you can confidently embark on your home rental journey with a clear understanding of your budget and long-term financial goals.

Calculate Your Monthly Income

Accurately calculating your monthly income is the first step in creating a realistic rental budget. This involves totaling all sources of your predictable, regular income.

For salaried employees, this is typically your net pay (after taxes and deductions). For those who are self-employed or earn variable income, calculating an average income over the past few months may be more suitable. Be sure to consider any additional income sources, such as alimony or investment returns if applicable.

Recording your income provides a clear picture of your available funds for rent and other expenses, ensuring you can comfortably afford your chosen home.

List Your Fixed Expenses

Fixed expenses remain the same each month. Accurately listing these is crucial for a realistic budget. Common fixed expenses when renting include:

- Rent: This is typically your largest fixed expense.

- Renter’s Insurance: Protects your belongings in case of damage or theft.

- Utilities: Some utilities, like internet and trash, often have predictable monthly costs.

- Loan Payments: Student loans, car payments, or other personal loans.

- Subscriptions: Streaming services, gym memberships, etc.

Carefully record the exact amount for each fixed expense. This provides a solid foundation for your rental budget.

Estimate Rental Costs

Estimating rental costs accurately is crucial for effective budgeting. Rent is typically the largest expense. Beyond the monthly rent payment, consider additional costs.

Utilities such as water, electricity, gas, and internet should be factored in. Security deposits, often equal to one month’s rent, are usually required upfront. Some landlords also require application fees.

Parking can be an additional expense, particularly in urban areas. If pets are allowed, anticipate a pet deposit or monthly pet rent.

Research typical costs in your desired area. Online real estate platforms can provide helpful data on average rent prices and associated costs. Consider using a spreadsheet or budgeting app to organize these estimations.

Include Utility and Internet Bills

Utility costs are a significant part of renting. Factor in expenses like electricity, gas, and water. These can vary based on usage and seasonality.

Internet service is essential in today’s world. Research providers and plans to find an option that fits your needs and budget.

Set Aside for Emergencies

Renting a home involves more than just monthly rent. Unexpected expenses can and do arise. Creating an emergency fund is crucial for handling these situations without jeopardizing your ability to pay rent or other essential bills.

Aim to save at least three to six months’ worth of living expenses, including rent, utilities, and groceries. This fund serves as a safety net, allowing you to cover unexpected repairs, medical bills, or temporary job loss. Even small, regular contributions add up over time.

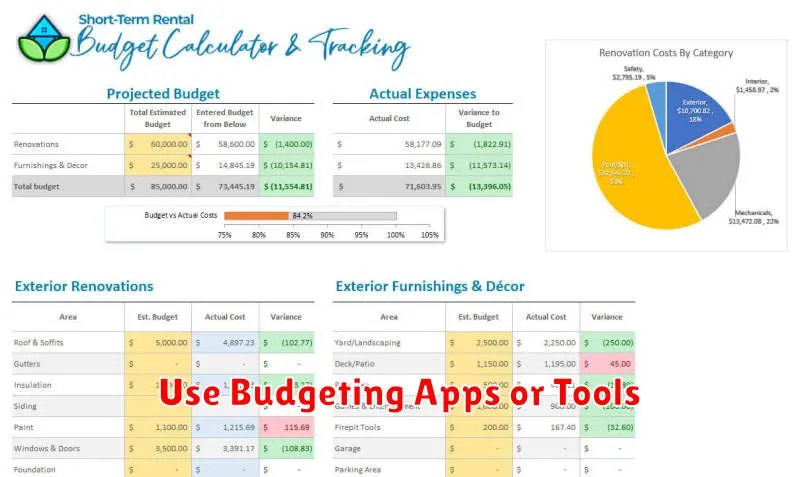

Use Budgeting Apps or Tools

Leveraging budgeting apps or tools can significantly simplify the process of creating and maintaining a budget for your rental home. These resources often provide automated expense tracking, personalized budgeting categories, and visual representations of your spending, offering valuable insights into your financial habits.

Many apps allow you to link your bank accounts and credit cards for secure, automatic updates. This eliminates manual data entry and ensures accuracy. Some popular options include Mint, YNAB (You Need A Budget), and Personal Capital, but many others cater to various needs and preferences. Consider exploring different apps to find the best fit for your financial management style.

Track Your Spending

Accurately tracking your spending is crucial for creating a realistic rental budget. Monitor where your money goes for at least a month. Several methods can help you achieve this.

Use a budgeting app. These apps connect to your bank accounts and automatically categorize transactions, offering a convenient way to visualize your spending habits.

Alternatively, maintain a spending spreadsheet. Categorize expenses such as groceries, transportation, and entertainment. This hands-on approach provides a clear picture of your financial outflows.

Finally, the envelope method, while less technological, can be effective. Allocate cash for different spending categories into separate envelopes. This tangible approach limits spending by providing a visual representation of remaining funds.

Cut Unnecessary Expenses

Creating a realistic rental budget requires identifying and eliminating non-essential spending. This often involves making difficult choices, but it’s crucial for comfortable and sustainable renting.

Start by carefully examining your current spending habits. Track your expenses for a month to understand where your money is going. Look for areas where you can reduce or eliminate costs. Common unnecessary expenses include dining out frequently, subscription services you rarely use, and impulse purchases.

Consider less expensive alternatives. For example, prepare meals at home instead of ordering takeout, explore free or low-cost entertainment options, and cancel unused subscriptions. Small changes can add up to significant savings over time.

Review and Adjust Monthly

Creating a budget isn’t a one-time task. It requires ongoing review and adjustment. Each month, take time to compare your planned budget to your actual spending.

Identify any areas where you overspent or underspent. Were there unexpected expenses? Did you stick to your savings goals? This analysis will help you understand your spending habits and make necessary adjustments for the following month.

Adjusting your budget might involve reducing spending in certain categories, increasing your income, or revising your savings goals. This regular review ensures your budget remains relevant and effective in helping you manage your rental expenses and achieve your financial objectives.

Tips for Saving on Rent

Negotiate your rent. Before signing a lease, try negotiating a lower monthly payment with your landlord. This can be especially effective if you’re a desirable tenant with a good credit score and rental history.

Consider roommates. Sharing living expenses with a roommate can significantly reduce your individual rent burden and utility costs.

Look for rent concessions. Some landlords offer move-in specials, such as a free month’s rent or reduced security deposit, to attract tenants.

Relocate to a less expensive area. If feasible, consider moving to a neighborhood with lower average rents.